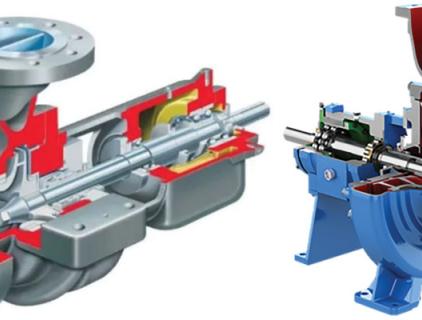

Zhongyuan Oilfield opens a new mode of intelligent brain 2.0 for oil wells

On June 17, at the Wen 72-129 well site of Wenliu Oil Production Plant in Zhongyuan Oilfield, production workers were debugging the parameters of the wellhead multi-parameter sensing device. This device is the latest monitoring device after upgrading. Compared with traditional digital pressure gauges and thermostats, this device overcomes the problems of poor performance, complex structure, and easy damage, and greatly improves work efficiency. At the same time, the “smart brain” of oil wells has been upgraded again. At present, the device has been widely promoted in oil fields. Since the application of this device, Wenliu Oil Production Plant alone has saved more than 1 million yuan in maintenance costs for digital pressure gauges and thermostats.