Russian crude exports hit four-month low amid weaker Chinese demand

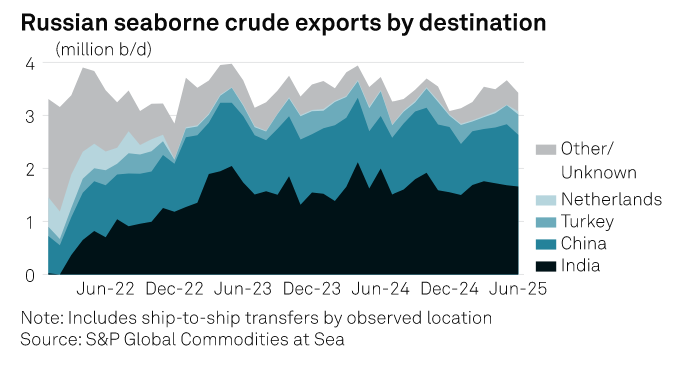

Russia's seaborne crude exports fell to their lowest in four months in June, according to cargo-tracking data, as Chinese buyers cut back their purchases amid refinery maintenance, less favorable pricing and a forecast rise in pipeline imports.

Russia-origin crude liftings from Russian ports reached 3.43 million b/d, down from a seven-month high of 3.67 million b/d in May but close to the year-to-date average, data from S&P Global Commodities at Sea shows.

The OPEC+ member in May exported 977,000 b/d to China, the second-largest buyer of Russian crude, down from a five-month high of 1.15 million b/d in May.

"An increasing number of Chinese independent refiners undergo scheduled maintenance in June and July, limiting demand for all Russian grades," CAS analysts said in a note.

In June, Russian ESPO Blend exports from the Pacific port of Kozmino to China amounted 728,000 b/d, a one-year low and down from 756,000 b/d in May.

The development has come as PetroChina's 200,000 b/d Dalian West Pacific Petrochemical Corp. plans to increase its intake of ESPO crude oil channeled through the border pipeline from this month, reducing its seaborne import requirements.

Sources familiar with the matter suggested that Wepec, which currently uses nearly 100% of this grade in its crude mix, could raise the share of pipelined ESPO in overall crude throughput to 87% this month compared with 24% in June, as it is cheaper than seaborne barrels.

CAS data suggests Russia reduced its exports of Arctic grades to 90,000 b/d in June from 107,000 b/d in May as Indian refiners returned to the market.

Chinese sources said Russia's light-medium sweet Novy Port for July arrival was offered at a $3/b premium to September ICE Brent futures, higher than $2-$2.30/b for June arrival, on a delivered ex-ship Shandong basis.

Russia exported nearly 1.66 million b/d to its top buyer, India, last month, marginally lower than 1.68 million b/d in May, CAS figures showed.

India may show stronger appetite for US crude as New Delhi looks to widen its supply sources and bridge the trade deficit with Washington, according to analysts and government sources.

More fuel oil, less gasoil

Seaborne flows of Russian oil products rose to almost 2.4 million b/d last month from 2.24 million b/d in May, with higher exports of dirty products, according to CAS data.

With demand from Middle Eastern power plants still strong due to a seasonal demand increase, Russia's exports of fuel oil and residues surged to 910,000 b/d from 818,000 b/d.

However, the country's gasoil exports dropped to 826,000 b/d from 865,000 b/d in the same period, mainly because of a 46% fall in Brazil's purchases to 99,000 b/d amid sanctions pressure.

The UK sanctioned 110 vessels and the EU sanctioned 189 in May in some of their largest enforcement actions to undermine Moscow's war chest against Ukraine, curbing Russia's shipping capacity in transporting fuels to South America's top oil consumer.

"The sanctions imposed by the EU and UK are relevant because a lot of Brazilian companies have operations in Europe," d'Amico International Shipping CEO Carlos Balestra di Mottola told Platts in an earlier interview.

Platts, part of S&P Global Commodity Insights, assessed that the monthly average premium of US ultra low sulfur diesel against all other origins, including Russia, at $2.782/b in June, up from $0.957/b in May.

Last month, some reports emerged that Russian authorities were discussing the possibility of enforcing a full gasoline export ban, which would apply to everybody, including large oil companies.

But Deputy Prime Minister Alexander Novak told local media that discussions only concerned extending the existing ban, which has included only non-producers or refineries with less than 1 million mt/year of capacity.