Resumption of Red Sea traffic likely to pressure European oil product markets: analysts

A resumption of Red Sea traffic could lead to more oil flows from the Middle East to the West-Suez markets and put downward pressure on Europe's refined product markets, according to analysts, even as the impact is expected to be drawn out, with shipowners taking a cautious stance over maritime safety.

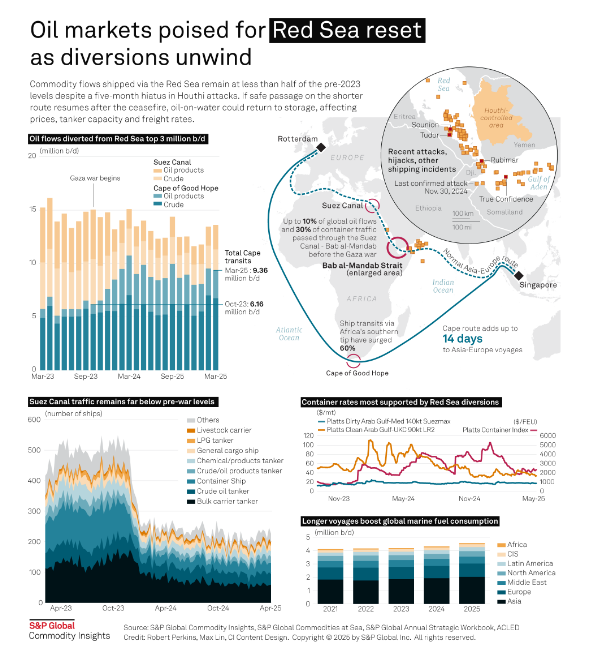

While many ship operators have avoided the Bab al-Mandab Strait due to Houthi threats since the Gaza war broke out in October 2023 and opted to sail around the southern tip of Africa, industry participants have been watching whether the trend would be reversed following the recent US-Houthi truce.

If ships are to forsake the longer route, which can save their voyage time two weeks and reduce bunker use, freight costs could theoretically fall and drive European importers to seek more refined products from their traditional suppliers in the Middle East.

Product tanker rates spiked in the first half of 2024 before giving up the gains due to increased ship supply. Platts, part of S&P Global Commodity Insights, last assessed the LR2 rate for transporting 90,000 mt of clean products from the Persian Gulf to UK/Continent at $42.78/mt on May 15, compared with an average of $88.73/mt in May 2024.

"[The development] could have an adverse effect on the European refining system ... Increased exports from Asia and the Middle East will likely put pressure on the European market, resulting in lower refining margins within Europe," said Das Premasish, a research director at Commodity Insights.

"The oil on the water will be reduced since ships will no longer need to navigate through the Cape."

Cape transits of oil products rose to as high as 2.6 million b/d in March from the pre-war level of some 870,000 b/d, according to S&P Global Commodities at Sea. Rough calculations suggest a complete unwinding of the additional traffic would bring some 24 million barrels -- mostly middle distillates -- onshore, potentially further pressuring product margins.

Refiners exposed

As energy prices have normalized from the shock of the Russia-Ukraine war, European refiners already first-quarter margins slide by as much as 60% year over year, drawing a line under a period of record profits.

This was despite the long lead times for Middle Eastern fuel deliveries, which helped to prevent a further slide, kept margins healthy by historical standards and deferred a wave of expected refinery closures.

Diesel/gasoil stocks in the Amsterdam-Rotterdam-Antwerp hub have stayed stubbornly low. In May, inventories sat at 15.5 million barrels, roughly 5% below the previous five-year average, according to Insights Global data, adding baseline support to prices.

Closures at Scotland's Grangemouth refinery and Shell's Wesseling plant in Germany earlier this year have compounded Europe's fuel deficit, propping up import demand and exposure to higher freight rates.

For European refiners, healthier-than-expected demand in the first quarter may have masked long-term margin pressure, but returning Red Sea traffic could deal a double blow to profits as economic headwinds start to bite amid tariff tensions.

Based on Commodity Insights' latest forecast, European nominal light-sweet hydrocracking margins are already expected to sink from 53 cents/b in April to 18 cents/b in August, after which levels could sink below zero for the remainder of the year.

Safety first

When and how freight market dynamics would exacerbate the bearishness remains up in the air, as many shipping companies suggest the Red Sea is too dangerous to return to.

"We will only consider a return to the region when we are 100% confident that conditions allow for safe and secure passage," Hafnia, one of the world's largest tanker operators, told Platts in an email.

Yemen-based Houthi fighters have claimed attacks on more than 130 merchant ships in the Red Sea and Gulf of Aden since the war in support of Palestinians, sinking two ships and killing four seafarers.

While the Iran-backed rebels have ramped down attacks since late 2024 and reached a ceasefire with the US in early May, safety concerns and still-high insurance premiums are keeping many ships away from regional waters.

The number of tankers sailing through the Suez Canal stood at 97 in the first week of May, much lower than the pre-war level of around 160, according to CAS. Meanwhile, Cape tanker transits reached 109, nearly doubled from the level seen before the war.

"Whilst recent announcements could potentially change the security dynamic in the region, given the profound impact of the Red Sea crisis on navigation in the region, they are unlikely to have an immediate impact," International Chamber of Shipping's secretary-general, Guy Platten, told Platts.

"It will take time for companies to regain confidence and also to reroute services that are now committed to voyages around the Cape of Good Hope," added Platten, whose organization represents more than 80% of the world's merchant fleet.