US has broad options to squeeze Russian oil sector if peace talks fail: experts

The US has a broad toolkit to impose more pressure on Russia -- with an equally wide range of potential oil market impacts -- if the peace talks proposed to take place on May 15 to end the war with Ukraine go awry, according to experts following the issue.

"The mood among US officials on the prospects for a deal is souring, and I expect we'll see tighter sanctions in the coming weeks if Russia continues to insist on maximalist demands," said Fernando Ferreira, director of geopolitical risk service at Rapidan Energy Group.

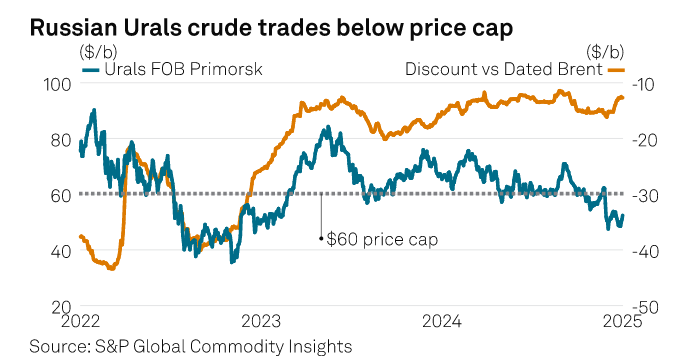

US options include secondary sanctions and tariffs on buyers of Russian oil, broader sanctions on the shadow fleet that carries Russian crude, sanctions on additional Russian LNG and oil players, and elimination of the $60/b price cap for Russian oil, experts said.

Threats without action would have little market impact, and expanded sanctions on the shadow fleet would lead to modest market tightening and price increases, said Rachel Ziemba, a senior advisor with Horizon Engage.

"A threat to do away with the price cap and leave no legal pathway for redirected trade would be more meaningful, especially because, with low oil prices, more trade is going on G7 ships," Ziemba said.

Secondary sanctions

Imposing secondary sanctions or secondary tariffs on countries that purchase Russian oil would force India, a major buyer of Russian oil, to drop Russian oil for fear of US punishments, said Clayton Seigle, a senior fellow at the Center for Strategic and International Studies.

But David Goldwyn, president of Goldwyn Global Strategies, argued that the US is unlikely to impose secondary tariffs because the US is not utilizing similar secondary tariffs that are authorized for China's purchases of Venezuelan oil.

"As long as China continues to get a free ride on its imports of sanctioned crude, it is unlikely that markets will be significantly impacted by any new sanctions taken by the US or Europe," said Goldwyn, who is also chair of the Atlantic Council Global Energy Center's Energy Advisory Group.

In April, Russia exported 1.643 million b/d of crude to India and sent 1.115 million b/d to China, according to S&P Global Commodities at Sea data.

Another stricter step would be imposing full blocking sanctions on additional large Russian oil and gas companies beyond the two companies, Gazpromneft and Surgutneftegas, that were hit with US sanctions earlier this year, Seigle said.

US President Donald Trump came into office believing that lower oil prices would force Russian President Vladimir Putin to curtail or end his war on Ukraine, Seigle said. But the price drop hasn't been big enough or long enough to motivate Moscow to change course, he said.

Spot FOB Primorsk Urals crude has averaged $50.63/b so far in May, down from $66.93/b in January, Platts assessment data shows. Platts is a unit of S&P Global Commodity Insights.

There are also domestic costs to this approach, since an oil price drop big enough to influence Putin would also hit the US oil and gas industry hard, Seigle said.

Commodity Insights analysts expect US oil production to average 13.5 million b/d in December 2025, flat on the year, and see production declining if WTI crude at Cushing, Oklahoma, falls below $60/b for an extended time. WTI at Cushing has averaged $60.15/b so far in May, Platts data shows.

In the end, it will depend on Trump's feelings about Putin's sincerity in the peace talks. "If Trump decides that Putin is not a partner, he may very well take stronger economic action against Moscow. All eyes are on Istanbul to see whether Putin shows up to engage with [Ukrainian President Volodymyr] Zelensky," Siegle said.

The US Treasury Department declined to comment on whether the US would impose new sanctions on Russia.

Peace talks

Putin proposed to hold high-level peace talks in Istanbul on May 15, after rejecting European calls to start a ceasefire by May 12 or face sanctions. Zelensky has said he would attend the talks, and Trump and Putin are still considering whether to attend.

Zelensky's decision to attend seems to have called Putin's bluff, ClearView Energy Partners said in a May 12 note. "If the Ukrainian leader shows up in Istanbul and his Russian counterpart does not, then Putin might be effectively daring Western leaders to follow through on their threatened sanctions escalation (this might be true if the leaders meet and talks fail too)," the note said.

The US does not need to choose between pursuing talks and tightening sanctions, said Olga Khakova, deputy director of European energy security at the Atlantic Council's Global Energy Center. In fact, this is an optimal time to ramp up pressure because US and European sanctions on Russia are finally paying off, she said.

Sanctions have already bitten into Russia's crude and condensate production, according to Commodity Insights analysts.

"Limited investment is expected to significantly impact oil production over the next decade. Crude output is expected to decline by 1.6 million b/d, falling from 9.0 million b/d in 2025 to 7.4 million b/d by 2035," the analysts said in a report.

"What a missed opportunity would it be for us to not take this very unique timing as energy prices have eased to push Russia over the edge towards a serious negotiating position, and a serious, genuine will to negotiate, because they are not there at the moment," Khakova said.