OPEC+ agrees to increase oil output by 137,000 b/d in October

OPEC+ will increase output by 137,000 b/d in October as a group of key producers within the bloc signaled they would begin unwinding a second tranche of production cuts of 1.65 million b/d.

The group of eight, covering Saudi Arabia, the UAE, Iraq, Algeria, Kuwait, Russia, Kazakhstan and Oman, has already agreed to unwind 2.2 million b/d of voluntary cuts by the end of September, one year ahead of schedule, in what many analysts have interpreted as an effort to claw back market share.

The latest in a string of announced production boosts that began in April was a 547,000 b/d increase in September, completing the unravelling of 2.2 million b/d of voluntary cuts.

However, in an online meeting on Sept. 7, the eight producers, which have been meeting monthly to set quota levels, turned their attention to a new tranche of voluntary cuts first announced in April 2023.

In a statement, OPEC said the group would undertake the hike in October "in view of a steady global economic outlook and current healthy market fundamentals, as reflected in the low oil inventories." Saudi Arabia and Russia will lead the increase with 42,000 b/d of additional production each.

The meeting lasted just 11 minutes, according to one source in the room. The producers agreed to meet again Oct. 5 and retain the option to pause or reverse the increases, OPEC said in its statement.

It is not yet clear if the increase will continue after October, but one delegate said the 137,000 b/d may occur monthly for one year, effectively phasing out the 1.65 million b/d of cuts in 12 months.

OPEC+ officials say the actual realized volumes could be lower than the announced increment, in the range of 60,000 b/d to 70,000 b/d, due to compensation efforts and production capacity constraints.

They added that the group is in a better position than in 2024 to "manage the market" after concluding the 2.2 million b/d of cuts.

Should OPEC+ complete that phaseout, it will leave just 2 million b/d of group-wide cuts in place.

Many analysts had expected the key producers to hold output flat after agreeing to conclude their 2.2 million b/d unwinding and hand the UAE an additional 300,000 b/d increase, particularly as only Saudi Arabia and the UAE are thought to have significant space capacity.

Iraq, Russia and others have not increased output in line with quotas in recent months, according to secondary sources used by OPEC to assess member output, in a bid to compensate for previous overproduction.

Meanwhile, Kazakhstan has been producing consistently above quota toward its maximum of around 1.8 million b/d, following the ramp-up of its key Tengiz project.

In its statement, OPEC said the October jump "will provide an opportunity for the participating countries to accelerate their compensation."

On Sept. 6, Iraqi Prime Minister Mohammed al-Sudani told an energy conference in Baghdad that his country’s “current export quota does not reflect its reserves, production capacity or population size,” according to a statement released by his office, setting the stage for a production hike.

Market tightness?

A year of further supply boosts after October is effectively OPEC+'s gamble on the tightness of the oil market.

Prices have remained in the low $60/b in recent months despite the OPEC+ unwinding. Sanctions action and threats against Russia and Iran have put a floor on prices. Meanwhile, the slightly lower price environment is expected to restrain US drillers, potentially enabling OPEC to regain some market share.

Platts, part of S&P Global Commodity Insights, assessed Dated Brent at $65.36/b on Sept. 5.

In a Sept. 7 note following the meeting, analysts from Commodity Insights said the move was bearish for oil prices but that "the increase in production was already priced in by the oil market."

OPEC ministers and officials have pointed to low global inventories as a sign that the market needs additional barrels, while backwardation of the crude market suggests near-term tightness.

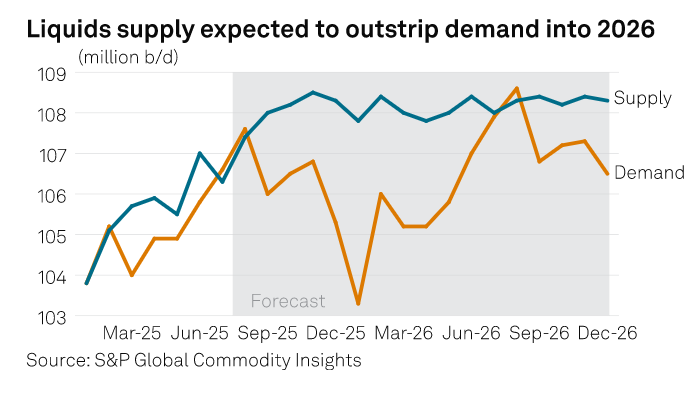

Nevertheless, analysts still predict a major supply overhang in the fourth quarter of 2025.

Commodity Insights analysts said in an Aug. 28 report that they continue to anticipate global oil and liquids production will surpass demand growth. As such, Platts Dated Brent is expected to average $68/b in 2025 under the base-case scenario.

However, that forecast was made before the announcement of a further 137,000 b/d increase in October.

One OPEC+ delegate, speaking on condition of anonymity due to the situation's sensitivity, said they were concerned about a supply overhang not only in the fourth quarter but also in the first half of 2026.

OPEC, for its part, remains more bullish than rival forecasters on global demand.

In its latest monthly oil market report in August, it said global demand would average 105.1 million b/d in 2025, with the “call” on its crude 560,000 b/d higher than its collective July output.