APPEC: Chinese small independent refiners rely on sanctioned feedstocks for survival

China's small independent refineries are nearly absent from APPEC 2025 in Singapore for the third consecutive year, as they cut spending and halt new investments, and with many opting out due to a lack of interest in re-entering the mainstream crude market to engage with Western trading firms, a trend that has persisted since 2023, sources from these refineries told Platts on the sidelines of the conference Sept. 8.

The small independent refineries, mostly in Shandong province, have increasingly turned to sanctioned crude oil supplies for significant cost benefits despite heightened US and EU sanctions in 2025 targeting Iranian and Russian energy, which now also include certain independent refining counterparts, terminals, storage facilities, and pipeline infrastructure in China.

The sources with the refineries added that sanctioned crude grades are their lifeline, helping them reduce losses amid China's declining demand for transportation fuels and tightening regulation policies, despite the risk of being sanctioned.

"Instead, we are more concerned about the possibility of supplies of the sanctioned crude being destroyed," said a Dongying-based refiner.

The persistence of these Chinese refineries in buying sanctioned crude has alleviated the intense competition in regular crude market, market analysts said.

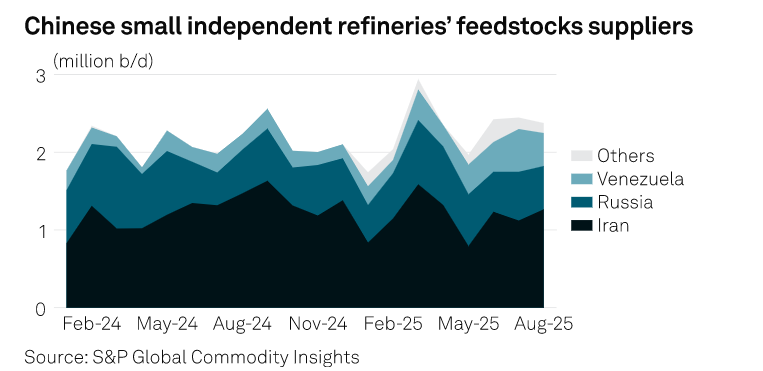

In the first eight months of 2025, the small independent refineries' imports from Iran, Russia and Venezuela accounted for 91.9% of their total crude oil imports, according to Platts data.

While this proportion declined from 97.8% in the same period of 2024 due to successive sanctions rounds, the absolute volume increased 3.1% year-over-year to 2.14 million b/d, Platts data showed.

Unbeatable prices

Sanctioned crudes from Iran, Russia, and Venezuela appeal to small independent refineries because the cargoes are typically offered at substantial discounts compared to regular barrels.

Lower feedstock costs help mitigate the downward pressure on the refining margins of small plants, as they face lower sales prices for refined products compared to their state-run counterparts, the refining sources said.

As of the week ended with Sept. 5, Iranian Light carried by non-sanctioned ships was offered at discounts between $5.5/b to $6/b against ICE Brent Futures on a delivered-ex-ship (DES) basis to Shandong province.

A Shandong-based trader said on Sept. 8 that offers for the Iranian cargoes carried by sanctioned ships were about $2.5/b lower than those that came in non-sanctioned carriers.

Therefore, Iranian crude imports accounted for about 50%, or 1.16 million b/d, of the small independent refineries' feedstocks imports in the first eight months, Platts data showed.

The heavy Venezuelan crude, with about 16 API, was at a discount of around $7-7.5/b to the ICE Brent future.

Offers for Russian ESPO were higher than these barrels, at ICE Brent Futures plus about $2/b on the same basis, but still lower than the premium of $4-$5/b for Brazilian Tupi, according to market sources.

S&P Global Commodity Insights anticipated that the gross refining margins for small independent refineries would be 45 cents/b in September, in stark contrast to the $4.92/b projected for state-run refineries.

Independent refineries usually sell products at lower prices as they have a limited retail network compared to the state-owned ones.

Survival from sanctions

Sources from the small independent refineries indicated they are closely watching geopolitical developments, anticipating further sanctions as the likelihood of improved relations between producers and Western countries appears slim.

Trading sources added on Sept. 8 that the Chinese government's support enables the continuous operation of the sanctioned plants and sustains the flows.

As of Sept. 8, five of these refineries, totaling 27.3 million mt/year (546,000 b/d) of capacity, have been included in the US sanction list since 2020 regarding the purchase of Iranian crude.

The three facilities sanctioned in 2025, with a combined capacity of 22.8 million mt/year (456,000 b/d), remain operational following a series of administrative adjustments to navigate the sanctions.

Their operations are supported by Beijing's consistent condemnation of the sanctions on Chinese firms as illegal and an example of 'long-arm' jurisdiction, with the government asserting that it will take all necessary measures to firmly safeguard the legitimate rights and interests of Chinese enterprises.

The government told the refiners that it would assist in coordinating operational issues between refineries and their ecosystems, including banking services, as needed amid sanctions.

Meanwhile, five oil terminal and storage facilities as well as one pipeline company in Shandong, Zhejiang and Guangdong provinces haven been sanctioned in 2025.

Despite some of the facilities having suspended operations due to the sanctions, some have become the leading terminals to dock sanctioned ships.

Iranian and Venezuelan barrels are usually transferred ship-to-ship in Southeast Asia waters to obtain Malaysia-origin or Indonesia-origin certificates before sending to China to skirt around US sanctions, Platts reported previously.