COMMODITIES 2026: Oil storage expands globally as energy security, trading drive demand

This is part of the COMMODITIES 2026 series, where our reporters bring to you key themes that will drive commodities markets in 2026.

Storing oil is a growing industry as governments worldwide seek to safeguard energy supplies, and traders increasingly rely on physical inventories to support their market strategies, adjusting to changing economics and geopolitics, according to industry analysts.

Commercial oil storage witnessed significant growth in 2025. According to Ursa Space Systems, global commercial oil storage reached 1.07 billion barrels by Dec. 25, up from 923.1 million barrels at the start of the year.

China leads the world in all onshore inventories, accounting for 31% of commercial, strategic petroleum reserves, refinery and non-refinery stockpiles, followed by the US at 11% and Japan at 8%. This expansion reflects a strategic shift as countries and companies look to buffer themselves against supply disruptions and market swings.

China's approach to oil storage has evolved from supporting demand growth to prioritizing energy security. The government has instructed refiners to increase stockpiling, according to Kpler analyst Yui Torikata, a move that many analysts attribute to bolstering oil prices through 2025.

The US has taken steps to replenish its Strategic Petroleum Reserve. In November, the US government made its first crude purchase for the SPR during President Donald Trump's second term, fulfilling his inauguration pledge to refill the reserve "right to the top."

Excluding the SPR, US crude oil inventories stood at 422.9 million barrels as of Dec. 26, up slightly from 421 million barrels a year earlier, according to the US Energy Information Administration.

Rising inventories are not limited to crude oil. Refined product storage is also on the rise in key trading hubs.

In Singapore, stockpiles rose to 49.4 million barrels by mid-December from 45.8 million at the end of 2024, according to Enterprise Singapore. The UAE's Fujairah Oil Industry Zone saw inventories increase to almost 19 million barrels from about 16 million barrels over the same period.

These hubs play a crucial role in the global oil trade, serving as waypoints for both consumption and re-export.

Eyes on China

Leading commodity traders and storage operators are expanding their footprints to capitalize on these trends.

Trafigura, one of the world's largest commodity traders, will add 1.3 million cu m of storage capacity for refined products in 2026 at the Port of Rotterdam through Impala Terminals, its 50-50 joint venture partner IFM Investors, according to a Trafigura statement.

Royal Vopak, a global storage giant, said in a Q3 analyst presentation that it plans to add capacity in Canada and outlined projects through 2029. The company will add a fourth tank at its GATE terminal in the Netherlands, raising capacity by 180,000 cu m by Q3 2026.

The US' biggest crude oil storage and export terminal, the Enbridge Ingleside Energy Center near Corpus Christi in Texas, is also increasing storage capacity to 20.5 million barrels, from 17 million barrels, as part of a Phase VII storage expansion expected to be completed in Q1 2026, Enbridge said in a statement.

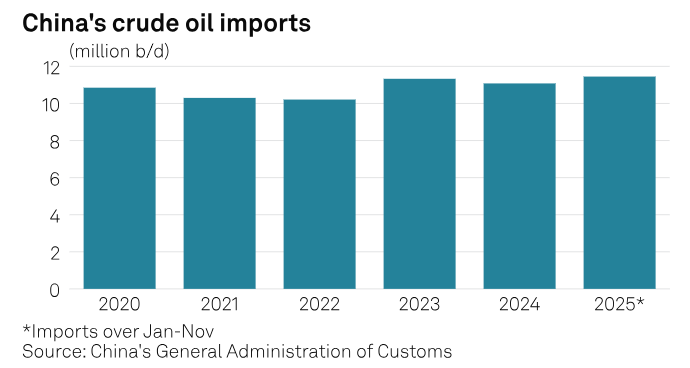

Much of the market's eyes are on China, which relies on imports for about 70% of its crude supply. The country produced 4.35 million b/d and imported 11.45 million b/d in the first 11 months of 2025, with refinery crude throughput at 14.82 million b/d, according to official Chinese data. This suggests a stock build of up to 330 million barrels during the period.

Industry sources expect about 271 million barrels of new commercial crude storage capacity to come online in 2026 across eight sites, pushing China's total capacity above 2.39 billion barrels. Much of this expansion consists of underground tanks, notably in Fujian province.

Shifting purpose

The growing need for storage is not solely a function of increasing oil demand. Instead, energy security, refinery closures, and the expansion of national oil companies into trading are driving the trend, according to Iman Nasseri, managing director for the Middle East at FGE Nexant.

Europe, which has shuttered or repurposed several refineries, is moving toward storage of "transition" fuels that require different tanks than more refined products, Lars van Wageningen, research and consultancy manager at Insights Global, told Platts, part of S&P Global Energy.

More storage will be needed for the import of chemicals and handling of low-carbon fuels like ammonia, methanol and sustainable aviation fuel for blending with jet fuel, he said.

Meanwhile, NOCs from the Middle East, including Saudi Aramco, Oman's OQ and Abu Dhabi National Oil Co., have established trading arms that require storage in key global markets. Aramco declined to comment, ADNOC said it had no comment and OQ didn't respond to a request for comment when reached out by Platts.

Their activity underscores the strategic importance of storage in maintaining trade flows and managing market risk.

"There is no huge justification in terms of oil demand growth for assets on the ground. Demand growth has always been there and is going to peak within the next 10 years," Nasseri said.

Instead, energy security, the rise of NOC trading arms, and the closure of refineries in mature markets are reshaping the industry, he said.