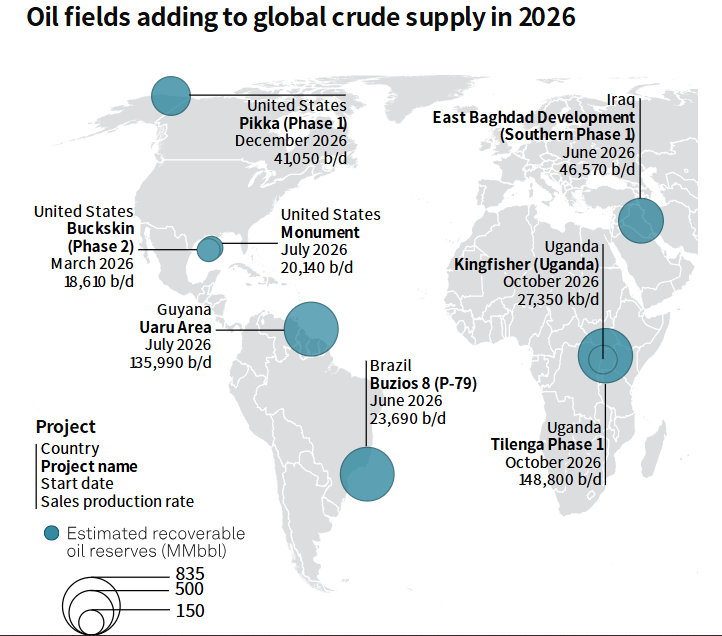

COMMODITIES 2026: Africa, South America hold biggest crude projects set to come online in 2026

Eight of the world's largest oil field developments scheduled to start up in 2026 could add more than 450,000 b/d to global oil markets, with the largest contributions coming from Africa and South America, and smaller additions from the US and the Middle East, according to data from S&P Global Energy CERA.

Uganda dominates the 2026 project list with two developments in its Lake Albert basin that, together, will contribute 176,000 b/d. The Tilenga project, operated by France's TotalEnergies, represents the single largest addition at nearly 149,000 b/d in 2026, while the CNOOC-operated Kingfisher project will add 27,000 b/d. Both projects are expected to reach a combined plateau production of 230,000 b/d and produce an estimated 1.4 billion barrels over at least 20 years.

Although some projects still face infrastructure and execution risks, the new supply additions could exacerbate an expected oversupplied market this year, and at least some of the barrels will offset natural declines in mature fields, according to oil market analysts.

"Although several new upstream projects are expected to come online in 2026, the reliability and effective marketability of these incremental volumes remain subject to material, technical and execution risks," Saudi-based independent energy consultant and analyst Abdulaziz al-Muqbil said.

For example, the 1,443-km East African Crude Oil Pipeline, which will transport Uganda's crude to Tanzania for export, has reached 75% completion but faces ongoing delays from environmental opposition. The pipeline is expected to start operations by July 2026.

"These factors increase the probability that nominal capacity additions translate into intermittent or delayed flows rather than sustained, marketable barrels," Muqbil said.

The biggest new supply sources are found in non-OPEC+ countries, the CERA data shows, with Uganda and Guyana home to the largest fields scheduled to begin producing in 2026. Most of that supply is located offshore.