Shandong Weima Pumps Manufacturing Co., Ltd

was established in 1996, which is an integrated service provider in research & development of oil and gas lifting technology, equipment research, technical services.

Shandong Weima Pumps is listed in 2014, Stock short name: Weima Stock, Stock Code: 430732.

Weima is a national new high-tech enterprise, and has a number of patented technology, and many of technologies are filled the blank of the industry.

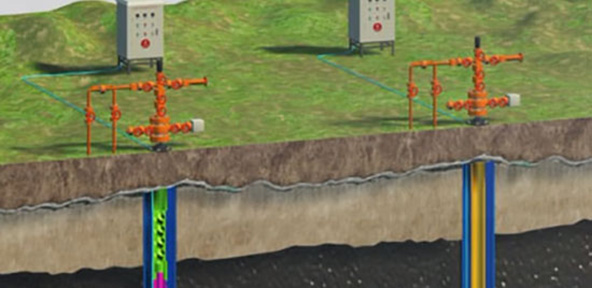

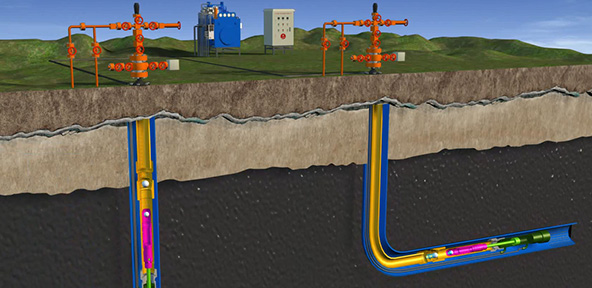

In recent years, Weima has provided more than 500 design solutions of crude oil, coal bed methane, and shale gas, etc. for users one after another.

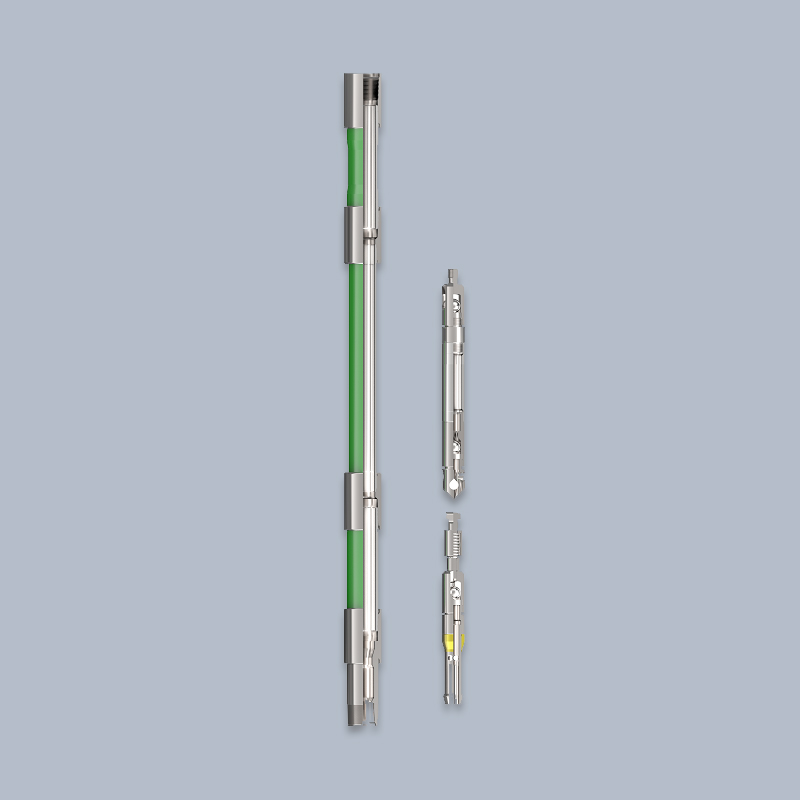

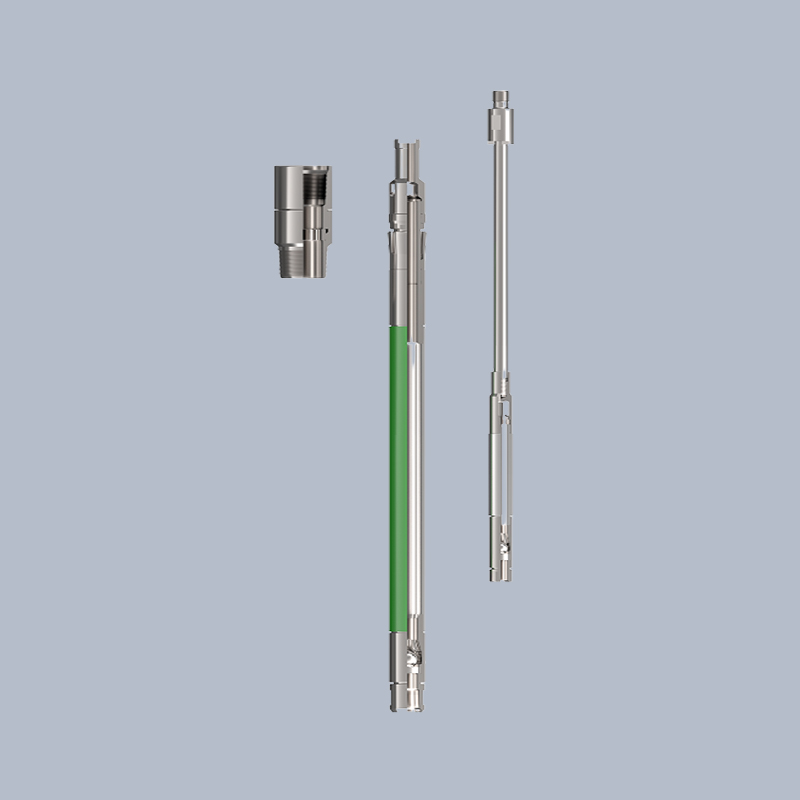

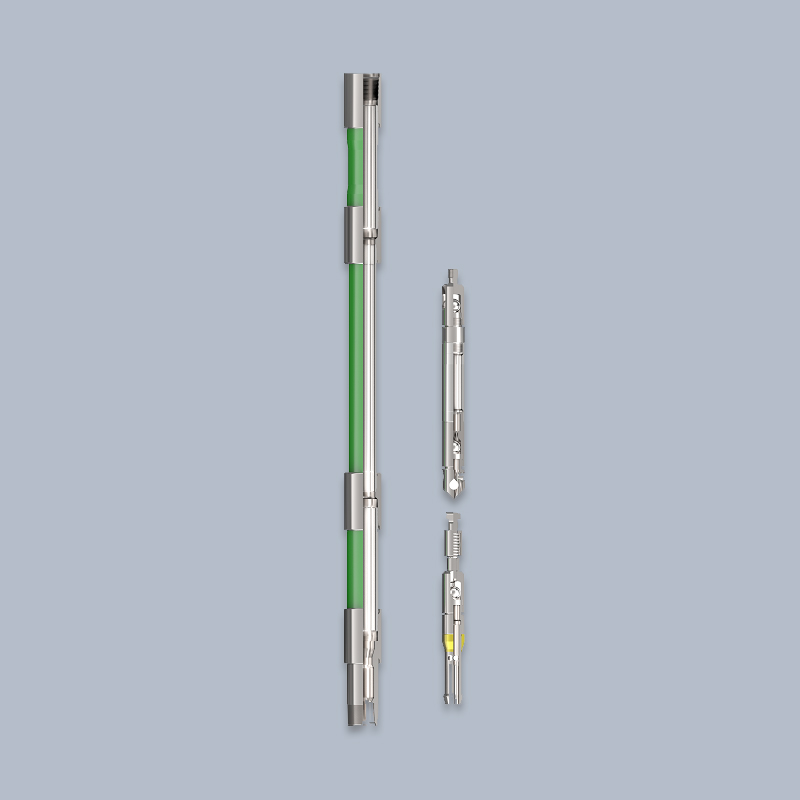

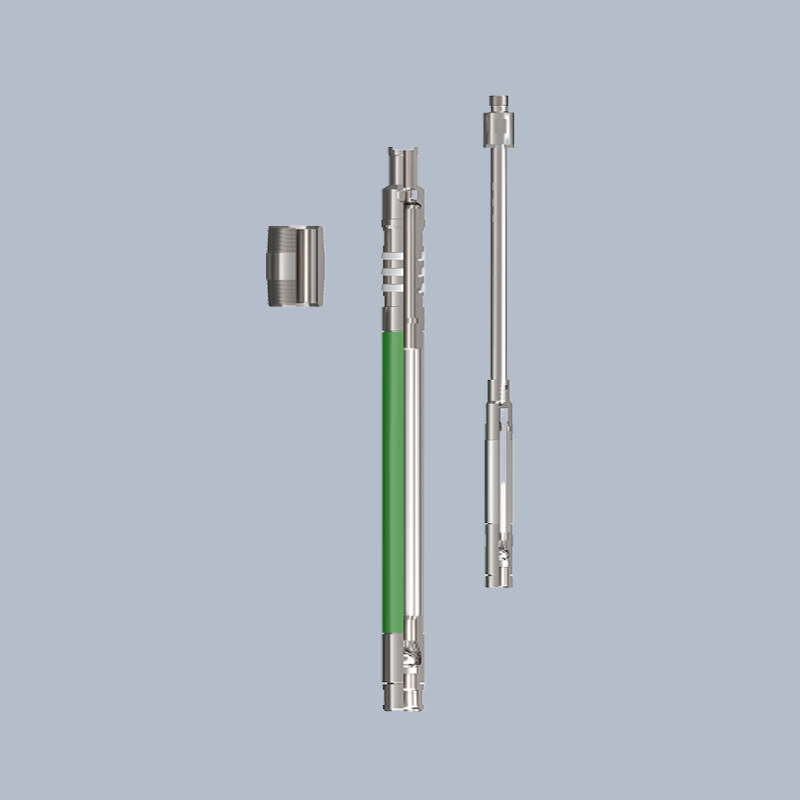

At home, Weima Stock is primary network material supplier of PetroChina, Sinopec;At abroad, Weima Stock is the qualified supplier of Petroleum Development of Oman (PDO).Weima developed sucker rod pump, specialpump, screw pump, permanent magnet motor and rodless oil production system independently. The products is widely used in PetroChina, Sinopec, CNOOC and Yanchang Oilfield. Meanwhile, the products are entered

-

8 +Has set up 8 service centers

-

500 +Design solutions of crude oil, coal bed methane, and shale gas, etc. for users one after another.

-

15 +Products are entered the oil companies in 15 countries and regions including Oman, Syria, Mexico and Azerbaijan.

-

10 +Weima Stock has established more than 10 enterprise standards

Media Information

Submitted successfully

We will contact you as soon as possible