INDIA CEO SERIES: ONGC aims to widen energy offerings, maintain upstream focus

The India CEO Series by S&P Global Commodity Insights is a compilation of exclusive interviews by Asia Energy Editor Sambit Mohanty with some of the leaders of the biggest energy companies in India.

India's Oil and Natural Gas Corp. Ltd. plans to invest in new reserves and continue to push upstream growth as oil and gas will remain its core business over the next two decades, although a changing energy landscape will prompt a shift in its business portfolio by 2035, chairman and CEO Arun Kumar Singh said.

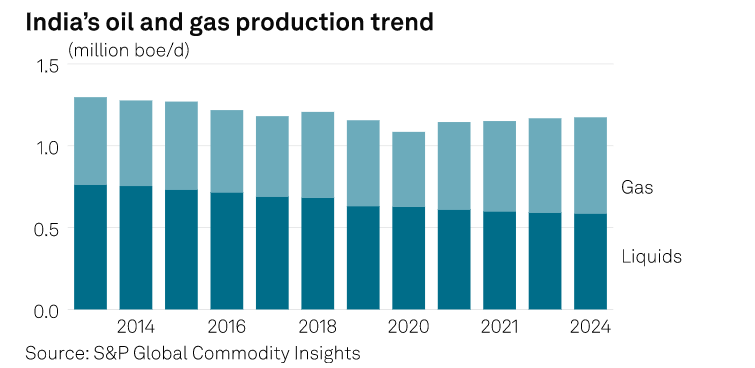

In an exclusive interview, he added that ONGC, which contributes close to 75% of India's crude oil output and around two-thirds of natural gas production, is well-positioned to lead the country's upstream growth -- a key priority for the government for ensuring energy security -- by adopting advanced technologies, with an emphasis on sustainability.

"My aspiration is to position ONGC not just as a traditional oil and gas powerhouse, but as an integrated energy company that is resilient to disruption and future-ready. This means expanding our core strengths in oil and gas exploration and production, while simultaneously accelerating investments in renewable energy, digital transformation, and advanced research and development," Singh told Platts, part of S&P Global Commodity Insights.

ONGC's crude oil output rose by 1.2% year over year to 4.683 million mt in the April-June quarter, the first quarter of fiscal year 2025-26. Natural gas production was at 4.846 Bcm in the same period, marginally down 0.3% year over year. In FY 2024-25 (April-March), ONGC's crude output rose 0.8% year over year to 18.56 million mt, while its gas output fell 1.6% year over year to 19.65 Bcm, according to company officials.

At the cusp of growth

India's upstream oil and gas sector stands on the cusp of significant growth over the next 5-10 years, propelled by a combination of rising energy demand, policy reforms, and untapped resource potential. The country's push to lower import reliance and boost domestic hydrocarbon output has rendered upstream development a national priority, Singh said.

The opening up of new sedimentary basins for exploration, and the government's push for investor-friendly policies -- such as the Open Acreage Licensing Policy and the Oilfields (Regulation and Development) Act -- are laying the groundwork for growth. These policy changes will attract both domestic and global players into the sector, Singh said.

"For exploration in deepwater and ultra-deepwater basins, the ORDA Act creates a more stable and enabling environment by addressing long-standing challenges related to regulatory clarity and procedural timelines. The introduction of time-bound clearances, deemed approvals, and redefined mineral oil classifications reduces uncertainty for operators, especially in areas where exploration cycles are long and capital deployment is front-loaded," Singh said.

According to Commodity Insights analysts, efforts are underway to increase investments in exploration activities in Category II and Category III basins, which contain contingent and prospective resources requiring active exploration and monetization, particularly in frontier areas such as deepwater and ultra-deepwater. Should the reforms proposed in the ORD Amendment Bill 2024 be integrated into the OALP in ongoing and future bidding rounds, there is a possibility of increased interest from global oil majors, which could significantly enhance exploration efforts.

Challenges remain

Highlighting some other policy developments, Singh said that while the government had released 1 million sq km of 'No-Go' area for exploration, it had also established a National Data Repository to improve data accessibility, as well as and simplified environmental clearance procedures to expedite project approvals.

Despite these advances, several challenges remain, necessitating further policy interventions to fully unlock the sector's potential, Singh said.

"There is a need to streamline the policies that foster domestic technological innovation and encourage partnerships for deepwater and ultra-deepwater exploration. As energy transition gathers pace, the policy framework must also evolve to support carbon capture, utilization and storage (CCUS), and other sustainability initiatives, ensuring the upstream sector remains resilient and competitive in the years ahead," he added.

Commenting on the global upstream outlook, Singh said the upstream sector had endured significant volatility over the past decade and increasing scrutiny over environmental concerns. However, as of late, the sector has shown the ability to adapt. Upstream companies have streamlined operations, slashed costs, and embraced new technologies to enhance recovery and efficiency.

"Major IOCs and NOCs are cautiously expanding their capital expenditures. This revival is not just about returning to pre-pandemic output levels but about reshaping upstream portfolios for greater resilience -- balancing high-margin and low-cost barrels with an eye on energy transition initiatives," Singh said.

"The global push for decarbonization, coupled with the momentum behind renewables, is redefining investment decisions and project timelines. Yet, paradoxically, as energy security concerns rise in response to geopolitical disruptions and supply chain constraints, oil and gas remain vital components of the global energy mix," he added.

Embracing new businesses

Singh added that diversification for ONGC won't simply mean adding new assets but about strategically positioning the company across the entire value chain -- from upstream to downstream, and from hydrocarbons to non-fossil solutions.

"By 2035, I foresee ONGC's portfolio shifting significantly -- while oil and gas will remain important, their relative contribution will decrease as renewables, low-carbon technologies, and new energy services gain a larger share," Singh added.

Singh said that in recent years, the momentum behind energy transition -- from fossil fuels to renewables -- had faced significant headwinds. Many energy companies, once vocal about ambitious net-zero pledges and investments in green technologies, are now scaling back their transition plans.

"This cutback is driven by a variety of factors -- economic uncertainty, fluctuating demand, rising costs of renewable infrastructure, regulatory ambiguities, and geopolitical tensions that have disrupted supply chains. As a result, some corporations are doubling down on their core fossil fuel operations in an era marked by global energy insecurity," Singh said.

While it is understandable that companies must navigate practical and financial realities, this retreat from energy transition goals raises concerns, as the temptation to prioritize short-term profits over long-term sustainability may stall critical progress in mitigating climate change, he added.