OPEC hikes long-term oil demand forecast again, sees no demand peak

OPEC has doubled down on its rejection of the world reaching peak oil demand, again increasing its forecast for the amount of liquid fuels that economies will require by 2050.

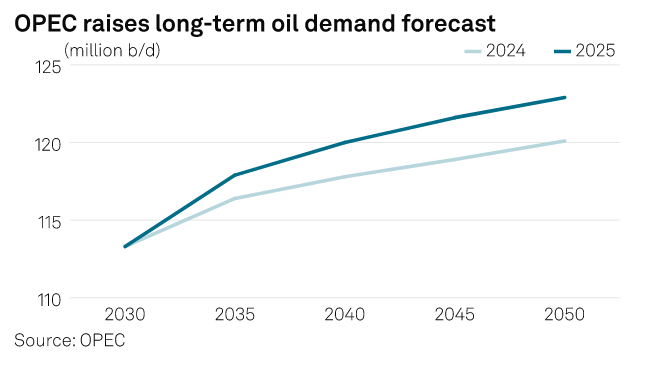

Policy shifts favoring energy security over energy transition, along with an improved economic outlook, will drive oil demand to 122.9 million b/d by 2050, OPEC said July 10 in its updated long-term forecast, up from its September prediction of 120.1 million b/d.

Pushes by environmentally minded governments and investors to swiftly phase out oil and gas consumption have been shown to be "unworkable and a fantasy," OPEC Secretary General Haitham al-Ghais said in the organization's World Oil Outlook.

"Many initial net-zero policies promoted unrealistic timelines or had little regard for energy security, affordability or feasibility -- this mindset is shifting," he said.

The updated forecast widens the gap between OPEC and the International Energy Agency, which has predicted a peak in global oil demand by 2030. OPEC and senior officials within the group have repeatedly criticized the consumer nation-focused watchdog for its pessimism on oil demand.

The IEA, which is due to issue its latest long-term oil forecast in October, projected in 2024 that global oil demand will see tepid growth to a peak of below 102 million b/d by 2030, before falling to 93.1 million b/d by 2050, as electric vehicle adoption gains speed.

OPEC's member economies are heavily dependent on oil revenues, and officials have complained that the IEA's forecast and net-zero advocacy are endangering investment in fossil fuels, which is required to meet energy needs and bring prosperity, particularly to the developing world.

In stating its case for sustained growth in consumption, OPEC cited policy recalibrations taking place in the US and many other key economies as they grapple with multiple priorities, including energy security, energy affordability, reducing emissions, sustainability and industrial competitiveness.

Since OPEC's last World Oil Outlook released Sept. 24, 2024, US President Donald Trump has returned to office and called for producers to "drill baby, drill!" to push oil prices down. Global conflicts, including in the Middle East and Ukraine, have also boosted the issue of supply security on many policymakers' agendas.

As in its previous forecasts, OPEC sees India, other Asian countries, the Middle East and Africa as the main sources of long-term oil demand growth.

"Combined demand in these four regions is set to increase by 22.4 million b/d between 2024 and 2050, with India alone adding 8.2 million b/d," OPEC said.

It maintained its near-term forecast for demand to reach 113.3 million b/d in 2030.

OPEC expects the transportation sector to continue to account for more than 57% of global oil demand out to 2050, with road transportation and aviation adding 5.3 million b/d and 4.2 million b/d, respectively. The petrochemical sector is expected to see a demand increase of 4.7 million b/d.

Market share

To meet the world's thirst for oil, OPEC and its allies will have to do much of the heavy lifting, the World Oil Outlook stated.

It estimated that the call on OPEC+ liquids, including NGLs -- the amount the group would need to produce to balance supply with demand -- will go from 49.1 million b/d in 2024 to 64.1 million b/d in 2050. This is up from its previous forecast for 2050 of 62.9 million b/d.

OPEC+ is a 22-nation alliance that includes OPEC's 12 members and 10 other key producers, led by Russia, that joined forces in 2017 to cooperate on managing the oil market through output quotas.

OPEC is aiming to regain market share from the mid-2030s, when it predicts that production growth outside of OPEC+ members will level off.

It forecasts total non-OPEC+ liquids production will hit a peak of around 60 million b/d in the mid-2030s, and then remain steady just below that until 2050.

The US will account for around 25% of this growth, with Brazil, Qatar, Canada and Argentina also adding barrels.

As non-OPEC+ supply plateaus, the OPEC+ alliance's share of global liquids supply will grow from 48% in 2024 to 52% in 2050, according to the forecast.

All of this will require the oil sector to make $18.2 trillion in investments by 2050, including $14.9 trillion for the upstream sector, with the downstream and midstream sectors requiring another $2 trillion and $1.3 trillion, respectively.

"The challenge of meeting these investment requirements is huge, and any shortfall in meeting these needs could impact market stability and energy security," the World Oil Outlook stated.

OPEC forecasts that global primary energy demand will rise from 308 million b/d of oil equivalent in 2024 to 378 million boe/d in 2050, primarily driven by growth in developing regions led by India.

It expects demand for all primary fuels apart from coal to increase to 2050.