ENERGY ASIA: Asia's fossil fuels addiction poses challenges for energy transition roadmap

Asia is stepping up efforts to accelerate its energy transition ambitions and create opportunities, but the region's deep reliance on fossil fuels and preference for relatively cheaper energy present a series of challenges for policymakers and companies looking to strike a balance between supply security, affordability, and sustainability.

When government officials, industry leaders and energy professionals meet in Kuala Lumpur next week to attend the three-day Energy Asia conference, not only the role of national oil companies in securing a net-zero future will be in the spotlight, but delegates will also be looking for answers on the roadmap for Asian companies facing pressure to deliver sustainable growth.

"Our common objective must be to transform not just the type of energy we produce but indeed the entire energy ecosystem. Only a transformation of that reach and magnitude can pave the way for an energy future that is diverse, secure, and reliable, and importantly accessible, to not just the advanced economies, but also to those who are emerging and developing. Nowhere are the stakes higher than it is here in Asia," said Muhammad Taufik, president and group CEO at Petronas.

As new governments and policymakers introduce sweeping changes to energy, climate and trade policies, the geopolitical competition is creating a more difficult global environment and complicating energy markets, investment decisions, and the pace of energy transition. As a result, striking a balance between energy security and energy transition will be a key goal, delegates added.

Challenges create opportunities

"Moving to new energy sources is even more of an opportunity for Asia than it is a challenge. There is a moment here where governments can bring their energy supply chains closer to home and manage them more completely within a national security framework -- something that has preoccupied the minds of leaders from India to Japan for more than half a century," said Dave Ernsberger, co-president of S&P Global Commodity Insights.

"It's no coincidence that China has made the electrification of its economy a top priority, despite cost considerations," he added.

Delegates and speakers scheduled to attend the conference said that Asian governments will increasingly witness louder appeals for government intervention in next-generation fuels markets, both in terms of clearer policy guidance and even in the form of subsidies and government investments.

While there is a big appetite for progress in hydrogen, ammonia, and renewable power, the returns on these investments remain low, making it increasingly difficult for the private sector to navigate this landscape independently.

"For many developing countries, oil and gas are critical components of their economic strategies, and for some, it is not easy to forsake inexpensive and secure coal. Experience is demonstrating that this transition will take longer, be more challenging and expensive and require trade-offs that tend to be downplayed," Daniel Yergin, vice chairman at S&P Global, wrote recently.

Oil demand, role of NOCs

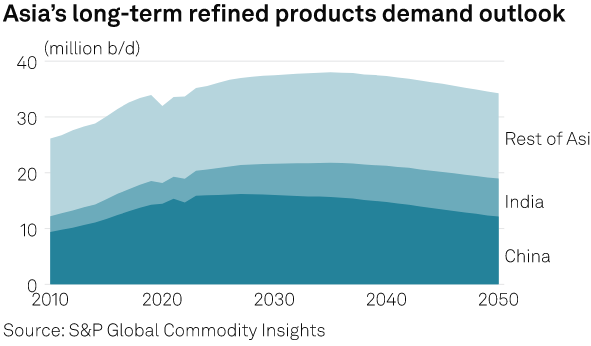

According to S&P Global Commodity Insights, a three-speed Asia will define the overall oil demand outlook to 2050. As China's pivot to a declining market is increasingly confirmed, the Asian market is set to run at different speeds -- gradual ongoing transition impacts in OECD Asia, a switch away from growth in China, and continued growth in non-OECD Asia.

China has pivoted from being the engine of global oil demand growth to a maturing, and now gradually declining, market as electrification, demographics, and policy shifts take hold. Meanwhile, India is now a critical counterweight to slowing demand in mature and transitioning markets, making it the central pillar of future refined product demand in Asia and a key driver of global oil consumption growth through at least the end of this decade, Commodity Insights added.

Delegates added that the oil refining sector was facing unprecedented challenges and opportunities, wherein refiners are rethinking their approaches to energy utilization, waste management, and product offerings to be engines for low-carbon energy. The emerging pathways to decarbonize refining were redefining the future role of refineries.

Vartika Shukla, chairman and managing director of Engineers India Ltd., said the refining industry was facing complex choices such as pressure to decarbonize liquid fossil fuels, alternatives for lower carbon crude and other feedstocks and integrating bio-derived fuels.

"Middle Eastern and Asian countries continue investing in refining, particularly where energy security and domestic demand remain strong. In contrast, Western economies are seeing a redirection of funds toward renewable energy and bio-refineries rather than traditional refining expansion," she added.

"The tightening of emissions regulations and carbon pricing mechanisms create uncertainties for investors. At the same time, the lack of clear global policy alignment on the future of refining makes long-term investment decisions difficult," she added.

And not just the downstream sector, even oil and gas companies in the upstream sector were facing challenges in adapting to a rapidly changing energy landscape, as they look out for strategies to address new basins, cost management, emissions reduction, and technological innovation.

Delegates added that national oil companies, such as Petronas and Saudi Aramco, with global influence, would have to play pivotal roles not only in reshaping their domestic energy landscapes but also in helping define how hydrocarbons, renewables, and low-carbon technologies co-exist in Asia's energy future.

From geothermal to nuclear

Delegates added that achieving Asia's net-zero would entail a deep decarbonization of the region's power sector, necessitating a significant acceleration of renewables deployment and penetration.

Another topic of discussion at the conference will be geothermal energy. There are expectations that it can offer a sustainable, reliable, and locally sourced alternative to meet Asia's growing demand for clean energy, as countries like Indonesia and the Philippines are sitting on some of the world's largest untapped geothermal resources.

Speakers are also of the view that even nuclear power has the potential to play a pivotal role in Asia's energy transition, offering a reliable, scalable, and low-carbon source of electricity.

New advancements in reactor technologies, particularly in small modular reactors, promise enhanced safety, cost-effectiveness, and flexibility, making nuclear power a more attractive option in the region. However, the integration of nuclear power into Asia's energy infrastructure faces numerous challenges, including stringent safety concerns, regulatory complexities, and substantial financing requirements.