TotalEnergies completes Bonga oilfield divestment off Nigeria

TotalEnergies has completed the divestment of its non-operated stake in the huge deepwater Bonga field off Nigeria, the French supermajor announced Nov. 25, netting it $510 million.

In a statement, the company said its local subsidiary TEPNG had closed the sale of its 12.5% stake in Oil Mining License 118 to fellow majors Shell and Eni, broken down as 10% and 2.5% respectively. The two companies are already partners in the development.

It comes exactly two months after the French company said Nigerian authorities had approved the sale. Shell initially agreed to purchase the entire 12.5% stake, but Eni later exercised its pre-emption rights to acquire an additional 2.5%.

The deal leaves Shell with a 65% operated stake in the prolific field, while Eni will hold 15%. ExxonMobil is also a partner in the deal, holding the remaining 20% interest.

After approval by regulator NUPRC, the deal went to Nigeria's oil minister for final consent.

First deepwater field

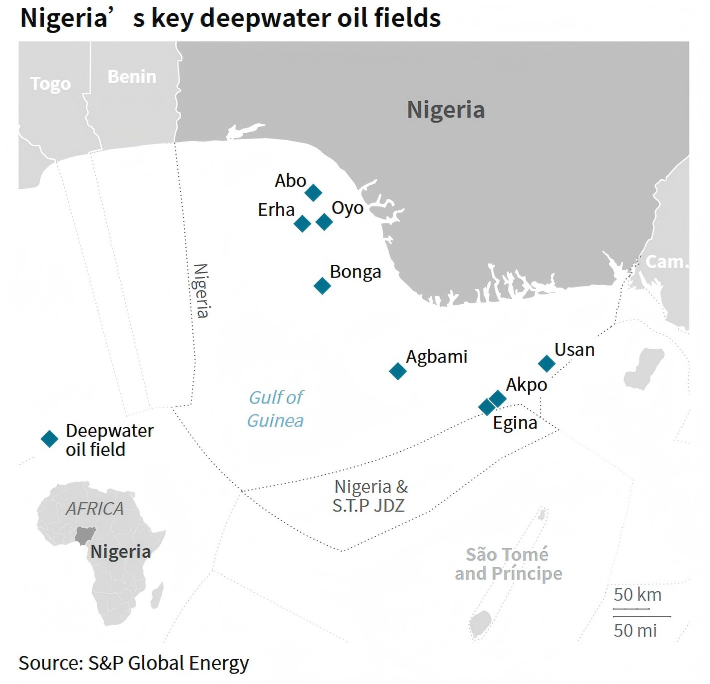

The Bonga field is Nigeria's first deepwater oil project, having achieved first oil in 2005. It has the capacity to produce up to 225,000 b/d of crude and 150 MMcf/d of natural gas and sits in water depths of 1,000 meters, around 120 km south of the banks of the Niger Delta.

According to the most recent update from NUPRC, Nigeria pumped 120,000 b/d of heavy sweet Bonga crude in October.

Spain, Canada, Peru and the Netherlands are key buyers of the grade, data from S&P Global Commodities at Sea shows.

In a statement of its own Nov. 25, Shell said the acquisition "represents another significant investment in Nigeria deep-water, and is part of Shell's strategy to further invest in competitive existing assets that contribute to sustained liquids production and growth in our Upstream portfolio".

It will also help Shell achieve its goal of growing integrated oil and gas production by 1% per year to 2030, it said.

Shell previously announced plans to carry out a huge expansion program on Bonga, through the Bonga North and Bonga Southwest projects. The partners took a Final Investment Decision on the former in December, with a view to adding 110,000 boe/d by 2030 through a subsea tie-back to the Bonga FPSO.

FID on Bonga Southwest could come as early as 2027.

The deal comes against the backdrop of an effort by international majors to quit the troubled Niger Delta in favor of more technically challenging -- but more secure -- deepwater projects like Bonga.

Conoil deal

TotalEnergies first entered Nigeria over 60 years ago and pumped 209,000 b/d in the African country in 2024, it said in its statement.

It still holds stakes in onshore assets -- after its deal with local player Chappal appeared to fall through in September -- as well as the Ubeta Gas Field, the NLNG terminal and big offshore projects like Egina, Akpo and Ofon.

On Nov. 19, the French company said it had agreed to acquire a 50% operated interest in block OPL 257 from local player Conoil, which lies beside TotalEnergies' Egina South field.

The company plans to drill an appraisal well on the license in 2026 with a view to tying back to the Egina FPSO.

Meanwhile, while Conoil will take TotalEnergies' 40% participating interest in gassy OML 136, also located offshore.