Tanker with crude cargo from Sudan idles off UAE as bilateral ties sour

For the last 10 days, a tanker loaded with Sudan's Nile Blend Crude has been idling off the UAE port of Fujairah, unable to discharge its cargo as a diplomatic row threatens to close off trade between the two countries.

The UAE is the main buyer of heavy sweet crude from Sudan and its bigger-producing neighbor, South Sudan.

Deteriorating ties — stemming from accusations of Abu Dhabi's involvement in Sudan's brutal war that has dragged on for two years — may leave the countries scrambling for new customers, potentially reshaping the region's crude flows.

The UAE has now suspended "sailing permits" for voyages to Port Sudan, the sole loading point for heavy sweet Sudanese and South Sudanese crude, as well as prohibited cargo movements to or from the terminal, according to a directive from the UAE's Ministry of Energy and Infrastructure.

The order "concerning maritime interactions with Port Sudan" aligns with "the strategic interest of the United Arab Emirates," states the directive, seen by Platts, part of S&P Global Commodity Insights.

The Liberia-flagged Suezmax Pola has been caught in the crosshairs. Since arriving 80 km south of its destination Fujairah on Aug. 18, a week after setting sail from Port Sudan loaded with Nile Blend, Pola has not been permitted to enter the port to discharge.

"It's unclear about imports into Sudan but certainly all exports into the UAE are not happening," said one UAE-based trading source familiar with the situation, speaking on condition of anonymity due to its sensitivity.

Market sources have told Platts that procurement of key feedstocks in the Fujairah hub, including heavy, sweet Dar Blend crude – the other main grade produced by Sudan and South Sudan -- had been delayed, impacting some local refined product suppliers.

The UAE energy ministry could not be reached for comment.

Biggest buyer

Sudan's Bashayer terminal is the sole export route for a combined 170,000 b/d of Dar and Nile Blend crude from the two East African countries. Over the last five years, the UAE has been the biggest importer, taking 44% of crude exports from Port Sudan, according to CAS data, followed by Malaysia, Italy and Singapore.

Much of it has traditionally been processed at two Fujairah refineries, owned by Montfort Group and Vitol, although the former stopped operating in April, Platts reported at the time. Vitol was the charterer of the Pola vessel, CAS data showed.

However, the Sudanese war, which started as a spat between rival generals in April 2023 before degenerating into a battle for territory and natural resources, leaving thousands dead and millions displaced, has changed the dynamics on the ground.

The Sudanese Armed Forces have accused the UAE of backing their opponents, the paramilitary Rapid Support Forces, in the conflict, including with weapons smuggled through neighboring Chad. The UAE denies the claims.

Sudan formally severed ties with the UAE in May, just as drone strikes pummeled Port Sudan, the country's wartime capital and operating center for the SAF, raising concerns that crude flows would be impacted.

Regional flows

If it is long-lasting, the ban could disrupt crude flows in the region, forcing traders to find alternative buyers for Sudanese and South Sudanese crudes, including in Asia.

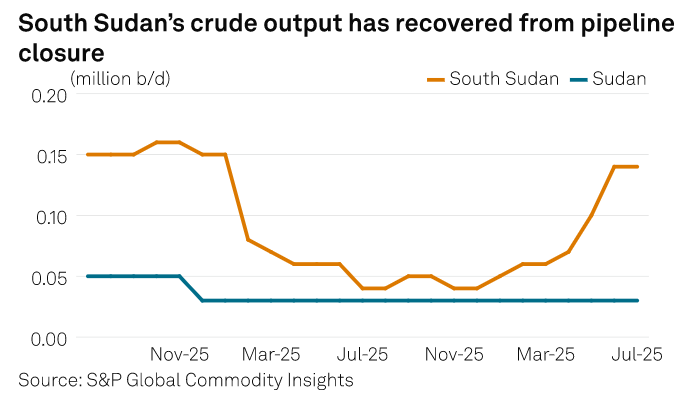

It comes on the heels of a 13-month pipeline shutdown, which slashed crude production in South Sudan by more than two-thirds to just 40,000 b/d until January, according to the Platts OPEC+ Survey from Commodity Insights.

Meanwhile, South Sudanese crudes have also seen their differentials impacted by ongoing fighting in Sudan, with some shippers hesitant to dock there at times.

There are also fears the country could return to a full-blown civil war, following the arrest of Vice President Riek Machar and oil minister Puot Kang Chol, jeopardizing a 2013 peace agreement amid an economic slump.