Oil markets brace for impact as Trump’s tariffs take effect

Aug. 7 was deadline day for US President Donald Trump's sweeping import tariffs, and oil markets are preparing for the aftershock now that new measures are in force.

Trump's April 2 "Liberation Day" unveiled the country's most aggressive tariff regime since the 1930s. But after months of frantic negotiations, it was midnight Aug. 7 that the US imposed its adjusted rates.

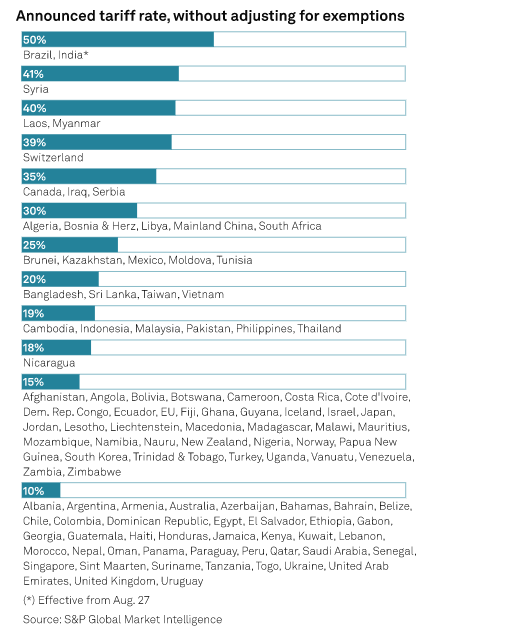

Tariffs on over 90 countries range from 10% to 50%, and bring the US average rate to 19.7% after adjusting for sector-level exemptions.

In the last four months, the EU, Japan, UK and others have all secured lower tariffs by striking trade deals, while Vietnam was surprised with a higher rate after a unilateral decision by Trump.

India is also readying for a 50% rate, double its initial level, after a clampdown on its Russian trade. Meanwhile, key trade partners Mexico and China remain locked in negotiations.

Price response

Unlike in April, when the first tariff announcements triggered a global market meltdown and Brent crude prices shed 19%, markets have held ground.

After closing at $66.8/b Aug. 6, ICE Brent front-months crude futures fluctuated Aug. 7 between a range of around $66.5/b to $66.5/b. Those levels remain well above the sub-$60/b price markets had flirted with in April, and comfortably higher than recent multiyear lows of $59.65/b May 5.

This time, traders have approached US tariffs with greater certainty, armed with the knowledge that crude oil and refined products have exemptions.

And despite a raft of grim forecasts in April, the absence of a major global recession has lifted hopes that the world economy can withstand higher tariffs. Nonetheless, markets remain exposed to an accelerating trade slowdown.

Although many tariffs have settled lower than proposed rates, the world economy is set to take a hit. According to S&P Global Commodity Insights analysts, GDP will grow at 2.4% in 2025 -- its slowest rate in 2025 since the 2008-9 financial crash and COVID-19 pandemic.

As a result, world oil demand growth is expected to reach 635,000 b/d of in 2025, based on Commodity Insights analytics, less than half the 1.3 million b/d projected before Trump's April tariff announcements. Downgrades reflect weaker-than-expected consumption in the US, China, the Middle East and Eurasia.

If the outlook deteriorates, key growth hubs even see tip into contraction, the International Energy Agency has warned, observing mounting pressure on countries like Brazil, India and Singapore.

India, a key engine of world oil demand growth, has already seen consumption growth slow to "just a trickle," the IEA said in its July oil market report, slashing its 2025 oil demand forecast by 90,000 b/d.

The world's largest independent traders have echoed a slowdown. Glencore, which reported its half-year results Aug. 6, saw an 88% drop in its energy and steelmaking coal trade year over year. Trafigura saw turnover stay mostly flat, but warned markets could suffer after a spate of preemptive trade activity driven by tariffs.

Future environment

The blow to global markets will be dictated by the stability of tariffs, with executives hoping for some respite from the policy yo-yo of recent months.

Many tariff rates are not legally binding, and rely on pledges to make massive, often unattainable investments in the US market.

The EU, for example, secured an agreement to halve its tariff rate to 15% by pledging to buy $750 billion worth of US energy in the next three years, a level most analysts have said could prove impossible to reach.

The outcome of tariff rates for Mexico and China will also set the tone for the economic outlook, as will threats of tougher tariffs for Russian trade partners.

"We've said it before, and we'll say it again: this 7 August date does not mark the end of the tariff saga, and higher tariffs on individual countries could still be imposed," said Inga Fechner, senior economist on Global Trade at ING.

On the flip side, ongoing legal challenges may still set back Trump's tariff agenda and take down trade barriers.

The US Court of Appeals for the Federal Circuit heard arguments on July 31 to determine whether Trump exceeded his authority by invoking the International Emergency Economic Powers Act to impose tariffs, with a ruling expected by mid-August.

Further legal battles are almost guaranteed. "Regardless of the court's ruling, an appeal to the US Supreme Court is an almost certainty by whichever side loses," said analysts including Ben Herzon, economics executive director at S&P Global Market Intelligence, in an Aug 7 paper.