Middle East Oil Prices Soar Amid Chinese Trading Frenzy

Middle East Oil Prices Soar Amid Chinese Trading Frenzy

· In a reversal of the global recession-induced slump in oil prices, Middle Eastern oil costs have surged due to elevated demand from Asian refiners in nations including China and Japan.

· This spike in demand is driven by high levels of activity on the Middle Eastern crude-trading window, with key industry players such as China's Unipec, TotalEnergies SE, and Shell Plc showing aggressive bids.

· Due to the high volume of trades, traders speculate that if physical cargoes become scarce, it may cause a further rise in prices, underlining a striking shift from earlier uncertainties in market direction.

At a time when global recession concerns have depressed global oil prices to pre-Ukraine war levels, prices of Middle Eastern oil have skyrocketed on soaring demand from Asian refiners in China to Japan as the market takes stock of heavy trading by the industry’s biggest names this month.

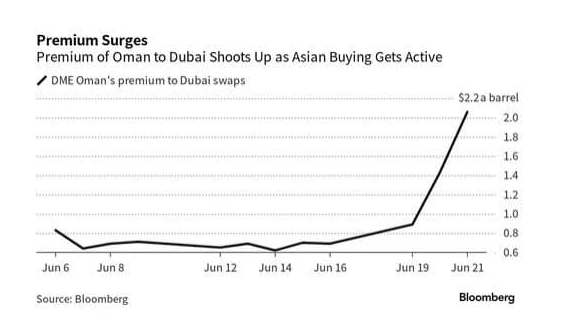

According to Bloomberg, spot differentials for August-loading Oman crude have jumped to more than $2 a barrel against the Dubai benchmark as of Wednesday, compared with 60-70 cents last week; premiums for Abu Dhabi’s Murban grade also rose - it’s rare for spot differentials to move more than 10-to-20 cents a barrel between days and deals.

The soaring regional prices have been underpinned by Asian refiners snapping up barrels over the past couple of days, including China’s Rongsheng Petrochemical, Taiwan’s Formosa Petrochemical and processors in Japan and Thailand, according to traders. A surge in activity on a normally sedate Middle Eastern crude-trading window has also sparked the interest of market participants.

For those asking where is all that pent up oil demand out of a post-covid China, here is your answer: Unipec - a unit of China’s top refiner Sinopec - TotalEnergies SE and Shell Plc have been going head-to-head with aggressive bids and offers of Dubai crude partial contracts on the so-called Platts trading window this month, an activity that goes into pricing a benchmark of the same name.

As Bloomberg explains, cargoes of crude including Oman, Murban and other Middle Eastern grades can be delivered from seller to buyer following the transaction of a set number of Dubai partials. Shipments are typically 500,000 barrels and Oman is one of the easiest to handle due to its high export volume and large pool of buyers and sellers.

So far this month, almost 40 Oman cargoes and two Upper Zakum shipments from the United Arab Emirates have been delivered, according to data compiled by Bloomberg, which is the most activity seen on the Platts window in years.

However, the number of Oman shipments equates to almost 70% of the grade’s exported volume in recent months. That’s led traders to consider whether sellers on the Platts window such as Unipec may curtail offers should physical cargoes become scarce. These concerns have contributed to a rise in prices, and may give room for more increases if sellers find it hard to get their hands on window-deliverable cargoes.

The sharp increase in sentiment (and price) is a dramatic turnaround from earlier in the month when traders were unsure about the market’s direction following contrasting trading on the window. Companies may also actively buy and sell on the window due to associated positions in Brent and Dubai paper markets.

The backwardation in prompt Dubai swaps also strengthened to the widest in six weeks Wednesday, while the premium of London’s Brent to the Middle Eastern benchmark — also known as Brent-Dubai EFS — was narrow at under $1 a barrel. Earlier this month, Saudi Arabia surprised the market with additional output cuts that were followed by a spike in official prices to all regions.

Bloomberg notes that last month cargoes of Oman, Upper Zakum and Murban crude for July loading were transacted for Europe and the US, shipments considered unusual, as Asian demand was soft at the time but that has since reversed notably. A US major sold Murban into the US west coast, traders said, while a trading company supplied Upper Zakum to Italy.

Western buyers considered spot Middle Eastern crude as affordable due to muted demand from Asia, where many refiners were undergoing seasonally planned maintenance work on plants, according to traders. It now appears that China is fully back in the market.