EU crackdown on Russian oil unlikely to deter China's crude purchases: sources

The EU's latest crackdowns on the Kremlin's energy industry will have a limited immediate impact on Chinese buying of Russian crude cargoes, trading, refining and shipping sources told Platts July 21.

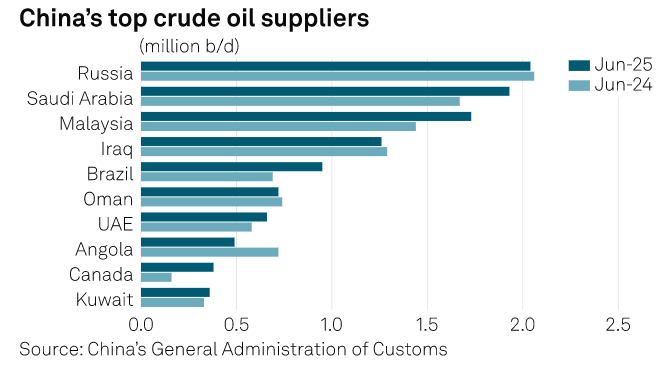

China is the top destination for Russia's crude supplies, via sea and pipeline. In the first half of the year, combined seaborne and pipeline imports dropped 10.9% year over year to 49.11 million mt (1.99 million b/d), with the market share declining to 17.6% from 20% seen over January-June 2024, according to China's General Administration of Customs data released on July 20.

The EU on July 18 banned imports of refined products made from Russian crude oil, lowered its oil price cap to $47.6/b from $60/b, and blacklisted more than 100 shadow fleet tankers.

Chinese buyers from both the independent and state-owned sectors were digesting the new package of sanctions as the trading cycle for the September-loading ESPO, the most favorable Russian grade, does not begin until later this week.

But nearly all sources indicated that the EU's sanctions are less effective against China than those imposed by the US, primarily due to the dominance of the US dollar as the world's currency, in contrast to the euro's lesser influence.

"We take the Russian crude cargoes on a delivery basis, so that neither shipping nor the FOB price is the primary issue we need to be concerned about," said a crude procurement strategist with a state-owned refiner.

Platts, part of S&P Global Commodity Insights, assessed front-month ESPO Blend at a $3.20/b discount to Platts Dubai crude assessments on a FOB Kozmino basis at the July 21 Asian close, up 5 cents/b day over day and tracking strengthening Middle East crude differentials. It can be translated into a flat price of $64.60/b.

Exposure risks

"Risk control of credit facilities varies; some banks would skip checking the vessel information when a deal only involves cargoes that have arrived at the [designed] ports, instead of cargoes in transit," said a Singapore-based commodity banker.

"However, if the deal is done in US dollars, the clearing banks, mostly in the US, would sometimes conduct random inspections on sensitive shipments, which included inspecting the legitimacy of the carriers," the banker added, suggesting higher exposure risks when a deal of Russian crude is done in US dollars.

A significant proportion of Russian crude deals are done in Chinese yuan, trading and refining sources said.

Paul Sheldon, a director with S&P Commodity Insights, said Russia is unlikely to see any supply disruptions from tighter EU sanctions. "Russia repeatedly demonstrates its ability to get oil to market by utilizing its dark fleet or holding its nose and selling into the cap," he said in a report dated July 19. "Moreover, the US and other G7+ countries have yet to agree."

The freight for hauling 80,000 mt of crude from Kozmino to North China stood at a lump sum of $1.5 million on July 21, unchanged from July 18 and July 17, Platts data showed.

China usually takes about 30 ESPO shipments loaded from Kozmino monthly, each about 100,000 mt in size.

Adding to about 800,000 b/d supplies via pipeline under a long-term contract between Resneft and CNPC, ESPO accounted for about 75% of China's crude imports from Russia.

Iranian crude more preferable

The reduction in Russian crude imports was mainly because China's independent refineries preferred the competitive Iranian crudes.

The sector's Russian crude imports fell to a four-month low of 650,000 b/d (2.66 million mt) in June, while Iranian crude imports rebounded by 43% from May to 1.68 million b/d, according to Platts data.

In the latest trading cycle, the August delivery ESPO cargoes were offered at ICE Brent plus about $2.20-2.40/b on a DES Shandong basis, rising from a premium of about $2/b for July delivery and $1.70-1.80/b for June delivery, market sources said.

In comparison, Iranian Light crudes were offered at a discount of around $3.00-$3.50/b against the ICE Brent Futures on the same basis.

As a result, China's total crude imports from Russia edged down by 0.3% from May to 8.35 million mt in June, falling 0.9% year over year despite the state-owned refineries stepping up buying, GAC data showed.

Iranian crudes are usually declared as Malaysia-origin blended barrels to skirt sanctions, according to market sources. GAC data showed China's crude imports from Malaysia rebounded from a four-month low of 5.07 million mt in May to 7.09 million mt in June.

Considering Iranian supplies, Platts estimated China's crude imports from the Middle East gained 1% year over year to 6.28 million b/d in the first half of the year, while those from the Commonwealth of Independent States, mainly Russia, dropped 9% year over year to 2.08 million b/d.